1. Executive Summary The global heated clothing market is projected to grow at a CAGR of 12-15% (2025-2030) , driven by technological advancements, increasing demand for outdoor activities, and an aging population seeking thermal comfort. This report provides a comprehensive analysis of market trends, supply chain shifts, and an expanded breakdown of heated clothing categories that are gaining traction.

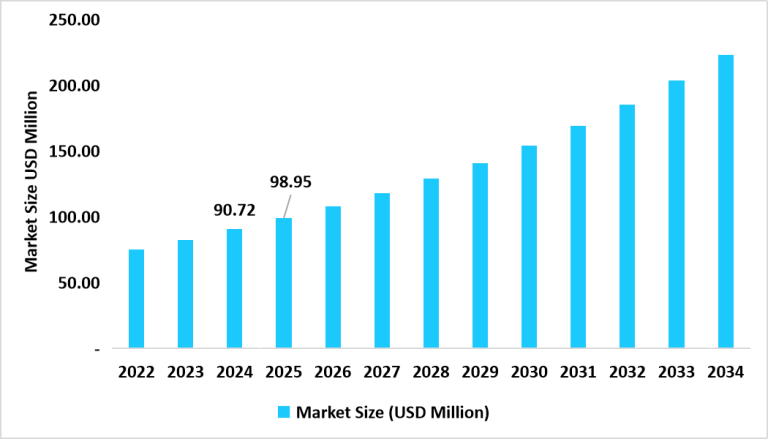

2. Market Overview (2025-2030) 2.1 Market Size & Growth

2024 Market Value: $1.5 billion2030 Projection: $3+ billionKey Growth Drivers:

Rising popularity of winter sports (skiing, snowboarding, hiking)

Smart heating technology (app-controlled, AI temperature adjustment)Medical & therapeutic applications (arthritis, Raynaud’s disease)

2.2 Google Trends Insights (2023-2024)

Top Searches:

“Heated jackets” (+40% YoY)

“Heated gloves for arthritis” (+55%)

“Best heated socks for hiking” (+35%)

“USB-powered heated vest” (+50%)

Peak Seasons: October–February (Northern Hemisphere winter)High-Interest Regions:

North America (U.S., Canada) – Largest marketEurope (Germany, UK, Scandinavia) – Strong winter sports cultureAsia-Pacific (Japan, South Korea, China) – Emerging demand

3. Expanded Heated Clothing Categories The market is diversifying beyond traditional heated jackets and vests. Below is a detailed breakdown of key product categories :

3.1 Upper Body Wear Product Type Key Features Target Audience Price Range Heated Jackets Battery-powered, 3-zone heating Outdoor workers, winter sports $150–$500 Heated Vests Lightweight, USB rechargeable Urban commuters, motorcyclists $100–$300 Heated Hoodies Casual wear with hidden heating elements Youth, everyday winter use $80–$200 Heated Shirts Thin, flexible heating for layering Office workers, mild winters $70–$180

3.2 Lower Body Wear Product Type Key Features Target Audience Price Range Heated Pants Adjustable thigh/knee heating Skiers, construction workers $120–$350 Heated Leggings Stretchable, women-focused designs Yoga, winter runners $90–$250 Heated Base Layers Silk/thermal fabric with heating wires Campers, military personnel $60–$200

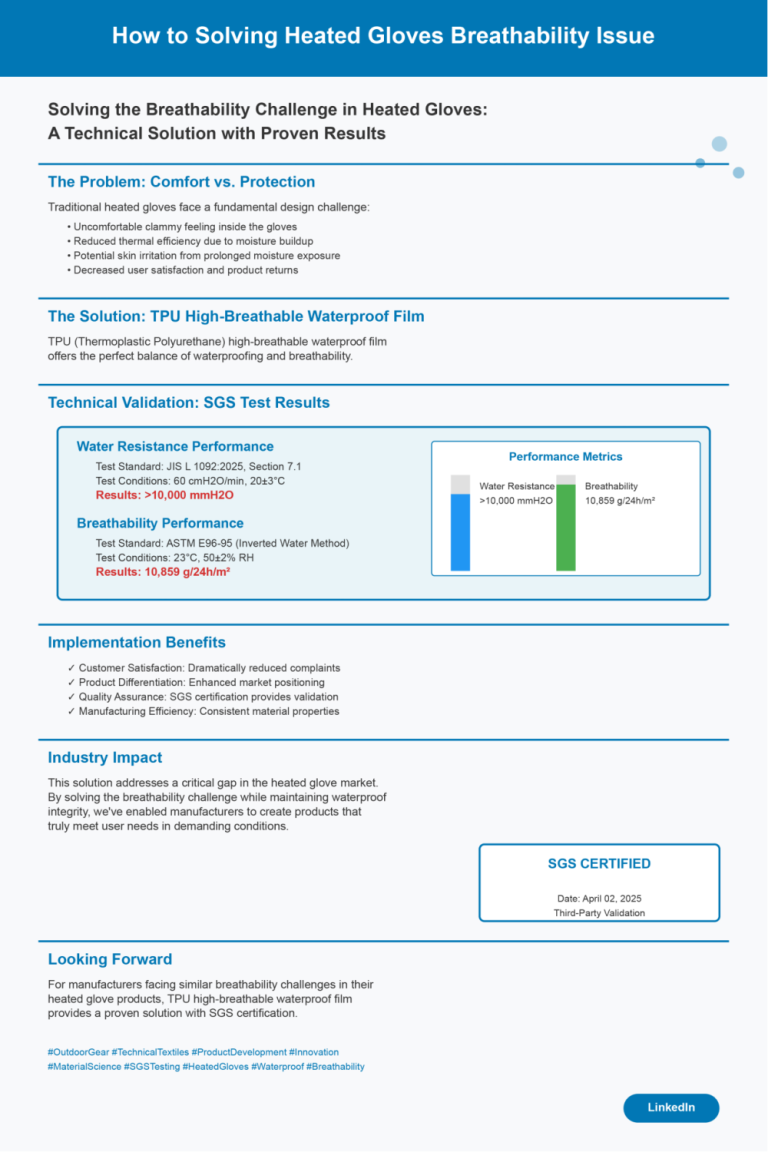

3.3 Accessories Product Type Key Features Target Audience Price Range Heated Gloves Touchscreen-compatible, waterproof Motorcyclists, outdoor workers $50–$200 Heated Socks 6–10 hours battery life, moisture-wicking Hikers, diabetics, elderly $40–$150 Heated Insoles Slim design for any footwear Daily commuters, winter sports $30–$120 Heated Scarves Fashionable, quick-heating Urban consumers $40–$100

3.4 Niche & Emerging Categories

Heated Sleeping Bags (for camping, emergency survival)Heated Pet Clothing (for dogs in cold climates)Heated Maternity Wear (targeting pregnant women in winter)Heated Motorcycle Suits (integrated with bike battery systems)

4. Supply Chain Shift: China to Southeast Asia & Beyond (Previous analysis remains relevant, but here’s a brief summary with new insights related to expanded product categories.)

4.1 Key Trends in Production Relocation

Vietnam & Bangladesh: Dominating apparel assembly (jackets, vests, pants).India: Emerging in electronics integration (heated gloves, socks due to growing tech labor).Mexico: Gaining traction for U.S. nearshoring (heated workwear for construction).

4.2 Challenges by Product Category Product Category Supply Chain Challenges Best Production Hub Alternatives Heated Jackets/Vests High labor costs in China Vietnam, Bangladesh Heated Gloves/Socks Need skilled electronics assembly India, Mexico Heated Base Layers Requires advanced fabric-tech integration Turkey, Portugal (EU-focused)

4.3 Where Is Production Shifting?

Country Advantages Challenges Adoption by Heated Clothing Brands? Vietnam Lower wages, strong textile industry, EU/US FTAs Rising labor costs, factory shortages Yes (Nike, Patagonia expanding) Bangladesh Cheapest labor, high garment export capacity Safety concerns, political instability Limited (basic apparel, not yet high-tech heated gear) India Large workforce, domestic market growth Bureaucracy, power shortages Emerging (Tesla, Apple moving; heated clothing still small) Cambodia Low tariffs (EU EBA scheme), cheap labor Weak infrastructure, corruption risks Minor role (low-tech sewing, not electronics) Mexico Nearshoring for U.S. market, USMCA benefits Higher wages than Asia, cartel issues Yes (some U.S. brands shifting)

4.4 Impact on Heated Clothing Manufacturing

Electronics & Battery Production: Still China-dominated (Shenzhen, Guangdong).Apparel Assembly: Moving to Vietnam, Bangladesh, India .Key Challenges:

Southeast Asia lacks China’s integrated supply chain (fabrics, heating elements, batteries).Higher logistics costs if components are made in China but assembled elsewhere.Quality control issues in new manufacturing hubs.

4.5 Future Trends in Supply Chain Relocation

2025-2026: More brands adopt “China+1” strategy (Vietnam primary alternative).2027-2030: India & Mexico grow as secondary hubs for U.S./EU markets.Smart Manufacturing: Automation in Southeast Asia to offset rising wages.

5. Future Opportunities (2025-2030) 5.1 By Product Category

Heated Activewear: Gym leggings & sports bras with heating tech.Medical-Grade Heating: FDA-approved wearables for chronic pain.Fashion-Tech Collaborations: Luxury brands x heated apparel (e.g., Moncler, Canada Goose).

5.2 By Region

Europe: Growth in heated cycling gear (e-bike commuters).Asia: Low-cost heated layers for mass-market adoption.North America: Smart heated workwear (construction, delivery drivers).

6. Conclusion & Recommendations

Product Expansion: Brands should invest in diverse heated apparel categories , especially accessories and niche markets (pet, maternity).Supply Chain Strategy:

Vietnam & Bangladesh for bulk apparel manufacturing.India & Mexico for tech-integrated products (gloves, socks).Localized battery production to avoid delays.

Marketing Focus: Target winter sports, medical, and urban commuter segments .

Sources: Google Trends , McKinsey Supply Chain Reports, U.S. Fashion Industry Association (USFIA), World Bank Data.